http://www.speakeasyfacilitators.co.za/speak-easy-flash-workshops/the-golden-art-of-money-talk/

“One’s relationship with money is lifelong, it colors one’s sense of identity, it shapes one’s attitude to other people, it connects and splits generations; money is the arena in which greed and generosity are played out, in which wisdom is exercised and folly committed. Freedom, desire, power, status, work, possession: these huge ideas that rule life are enacted, almost always, in and around money.”- John Armstrong

This post is a book review and an article about that one word which makes people squirm in discomfort, look the other way, change the topic, or simply excuse themselves. I am talking about money and our relationship with it.

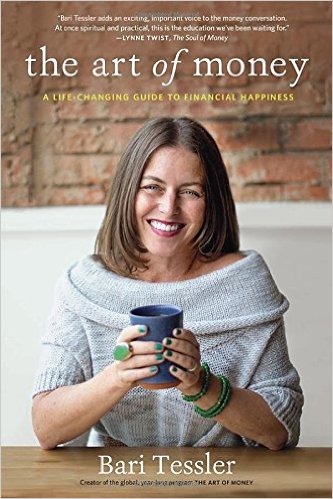

I recently read a book called “The Art of Money: A Life-Changing Guide to Financial Happiness” written by Bari Tessler, a financial therapist. She starts off by explaining how most people have a relationship with money based on their experiences in childhood, and that colors how they deal with their finances as an adult. Using examples drawn from various people in different financial situations, she encourages readers to identify their unique relationships with money, and how to transform this relationship, and ultimately transform their life.

This got me thinking about my approach to money and how it differs from that of my spouse. This appears to be a common problem in most families, where it is difficult to discuss finances without causing strong emotional reactions from either side. Many couples just shut off, and prefer not to talk about money, the question of which still hangs heavy in the air (the proverbial elephant in the room)! (Source: http://www.etsy.com)

(Source: http://www.etsy.com)

Money has acquired negative connotations throughout the history of mankind, yet success is measured largely by financial worth. This dichotomy makes it difficult for us to choose which side we are on- we neither want to acknowledge the supremacy of money in our lives, nor do we want to be unsuccessful. I think this is why we have such a hard time dealing with the question of money- because there is always a precarious balance between these two sides of the money coin.

Anyway, coming back to the book, it provides fascinating and interesting insights into human psychology regarding money, and provides you with a roadmap for financial rehabilitation. I definitely recommend this book- it is for everyone, irrespective of how much or how little you make.

Here are some things I learnt about my relationship with money:

- I don’t necessarily care for a lot of things that money can buy, but I feel good about making money as it represents success in life.

- I have an anxiety about being in debt, that might not be completely rational.

- I am somewhat afraid of investing long-term because it is money I cannot see at present.

- I love the thrill that comes with saving money. I give myself a pat on the back when I avoid that unnecessary online purchase or score a great deal.

- My attitude had been pretty much the same throughout my adult life- while in college, working for a stipend, or drawing a decent salary.

So, do you think you have the best possible relationship with money?

“Money, which represents the prose of life, and which is hardly spoken of in parlors without an apology, is, in its effects and laws, as beautiful as roses.“ – Ralph Waldo Emerson